Two of my favorite emerging market ETFs, the VanEck Egypt Index and the Global X MSCI Pakistan ETF, were delisted this year. The timing of listings, whether new creations or delistings, is often very inconvenient for the buyer. Pakistan had already rallied circa 20% in the months before its delisting, and the market could perform well as it is not generally correlated to developed market equities.

Source: MSCI

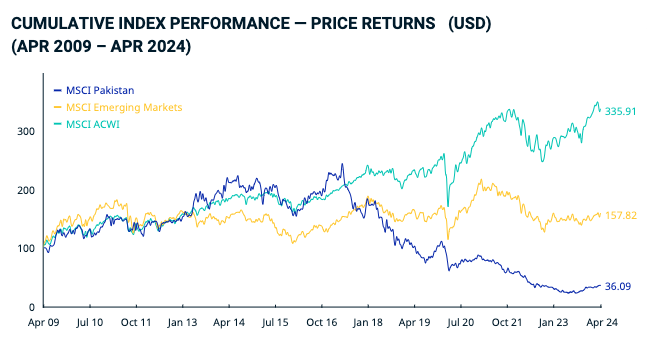

Pakistan previously outperformed world equities and emerging market equities prior to 2016, when it subsequently sold off due to the overhype of its emerging market upgrade, which actually left it with an insignificant weighting in MSCI Emerging Markets.

Egypt also sold off substantially in previous months due to another currency devaluation but now sits at an attractive 7.5x earnings vs. the MSCI Emerging Markets valuation of 15.6x earnings.

Egypt and Pakistan point out one annoying and cautionary tale for retail investors: US retail investors can’t invest in frontier and emerging markets and keep their portfolio diversified unless they want to invest directly on local exchanges.

The Silver Lining: South America